Interest-Rate Option Models

(税込) 送料込み

商品の説明

*12/2までの限定出品です*

Dr Riccardo Rebonato is Director and Head of Research at Barclays Capital. He is responsible for the modelling, trading and risk management of the European exotic interest-rate products. He holds Doctorates in Nuclear Engineering and Science of Materials/Solid State Physics. Before moving into investment banking he was Research Fellow in Physics at Corpus Christi College (Oxford). He has published papers in several academic journals in finance, and is a regular speaker at conferences worldwide.

書き込みなどはありませんが全体に古ぼけています商品の情報

| カテゴリー | 本・音楽・ゲーム > 本 > 洋書 |

|---|---|

| 商品の状態 | やや傷や汚れあり |

Interest-Rate Option Models : Understanding, Analyzing and Using Models for Exotic Interest-Rate Options (Wiley Series in Financial Engineering)

Interest-Rate Option Models:... by Rebonato, Riccardo

Interest-Rate Option Models : Understanding, Analyzing and Using

Interest-Rate Option Models:... by Rebonato, Riccardo

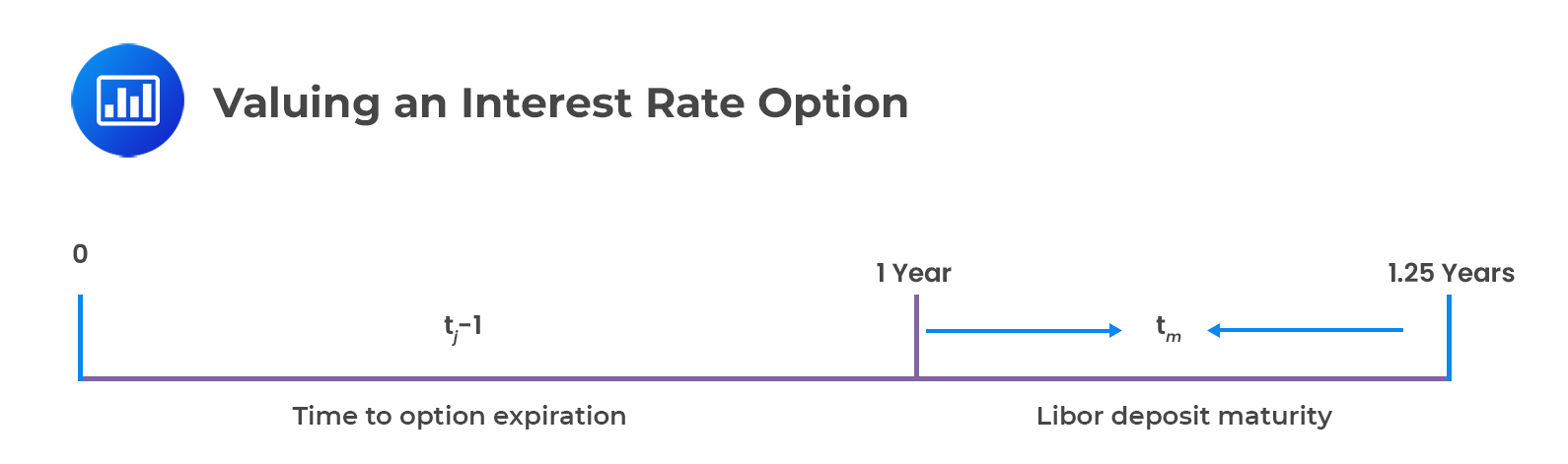

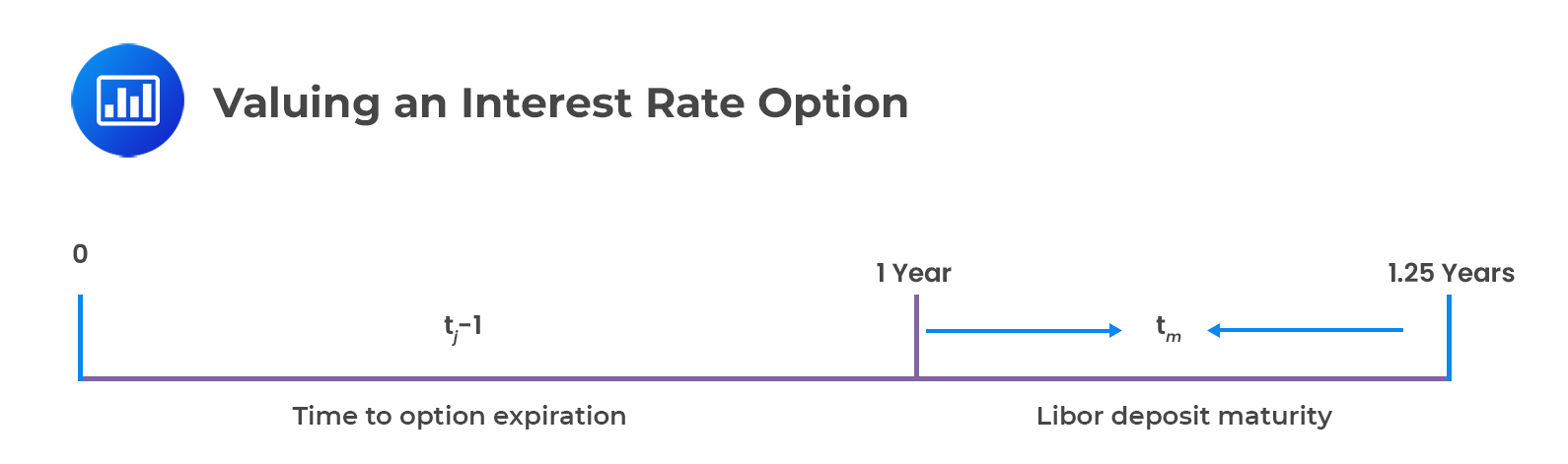

Valuation of an Interest Rate Option (2022 curriculum) - CFA, FRM

How and Why Interest Rates Affect Options

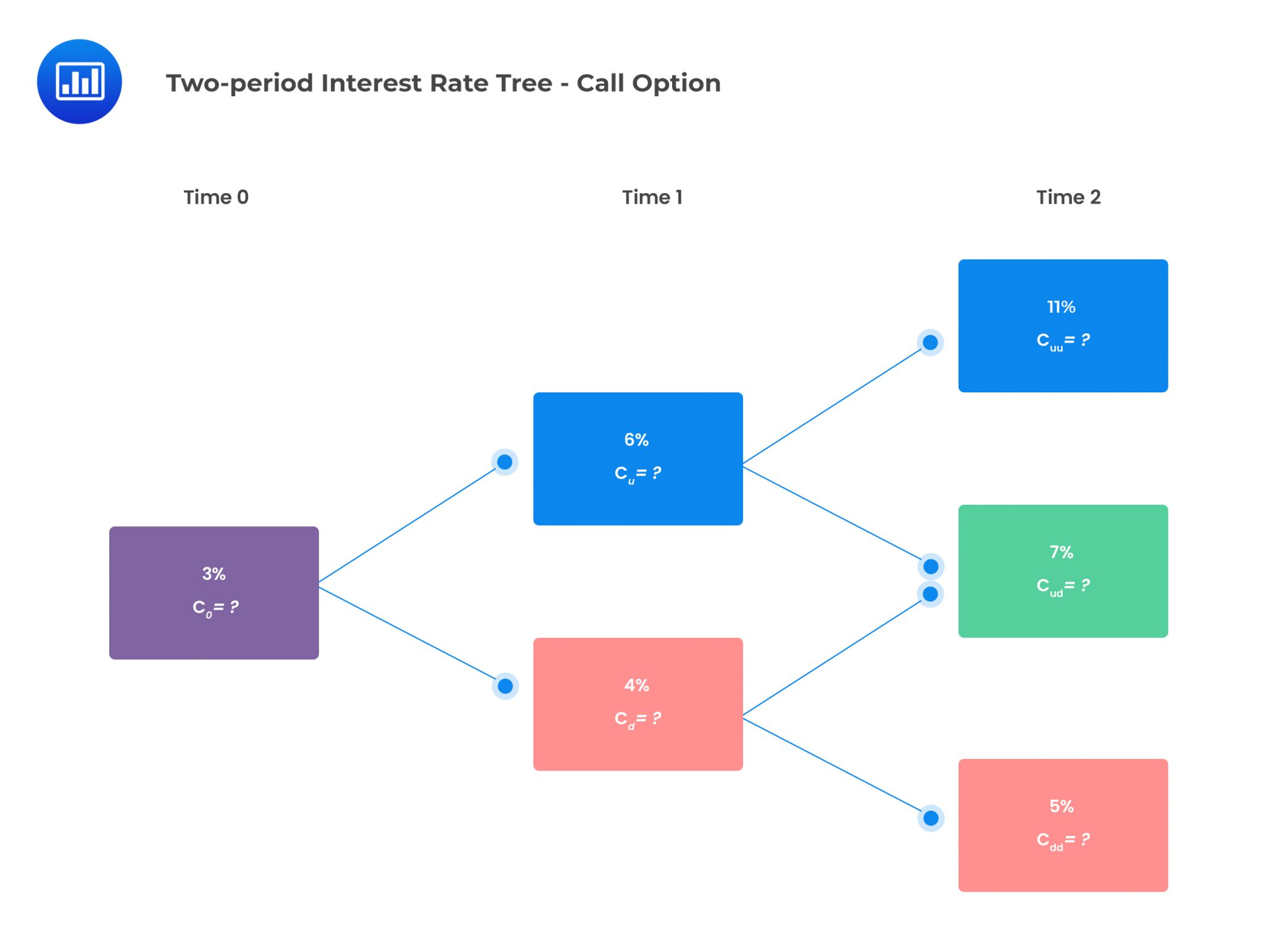

Navigating Interest Rate Options with Binomial Trees - FasterCapital

Interest Rate Options - What Is It, Examples, Types, Advantages

Interest-Rate Option Models: Understanding, Analysing and Using

Work with Negative Interest Rates Using Objects - MATLAB

CFA Level 2 | Derivatives: Valuing Interest Rate Options Using

Calculation flow chart of option-adjusted spread. | Download

Black Model Valuation of Interest Rate Options and Swaptions - CFA

Modeling Fixed Income Securities and Interest Rate Options (Chapman and Hall/CRC

Interest Rate Derivatives: More Advanced Models Chapter 24

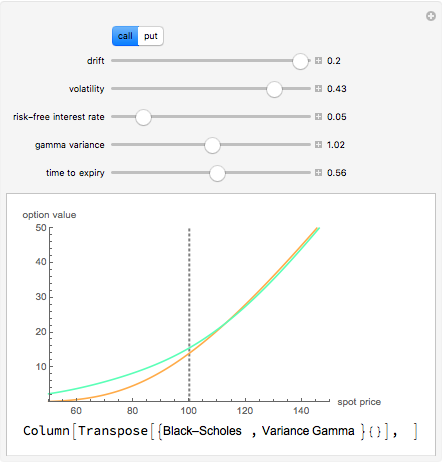

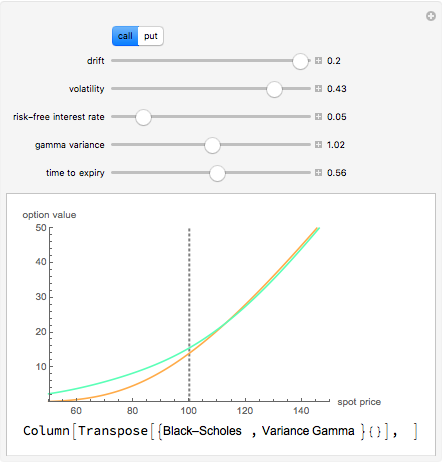

Option Prices in the Variance Gamma Model - Wolfram Demonstrations

Interest Rate Options - Overview, Importance, Risks

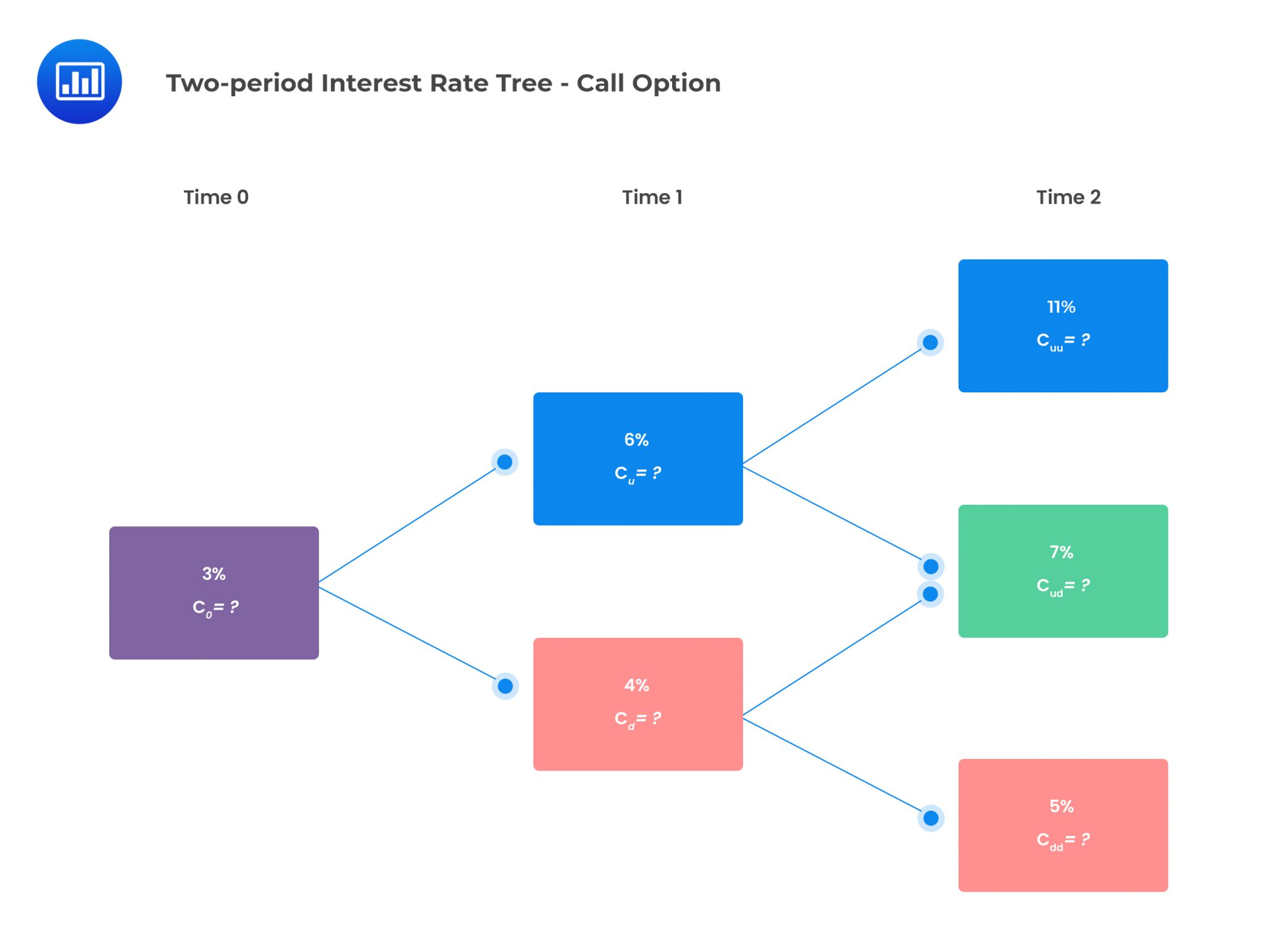

Understanding the Binomial Option Pricing Model

Interest Rate Derivatives and Mark to Market Losses: A

10 1 Introduction to interest rate models Part 1

Stochastic interest rate models news and analysis articles - Risk.net

Call option prices, volatility and interest rate in the Black

BLACK - SCHOLES -- OPTION PRICING MODELS

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing: Models, Formula, & Calculation

Interest Rate Options in Multifactor Cox-Ingersoll-Ross Models of

Interest Rate Derivatives: Models of the Short Rate - ppt download

Interest Rate Models - Theory and Practice: With Smile, Inflation and Credit (Springer Finance)

Navigating Interest Rate Options with Binomial Trees - FasterCapital

The price option profile f() against for various risk-free

Interest Rate Models and Negative Rates | FINCAD

Navigating Interest Rate Options with Binomial Trees - FasterCapital

black model-interest rate option-有问必答-品职教育专注CFA ESG FRM

How to Price Interest Rate Options with Negative Interest Rates

Chapter 30 Interest Rate Derivatives: Model of the Short Rate

Interest rates: The Impact of Interest Rates on Prepayment Models

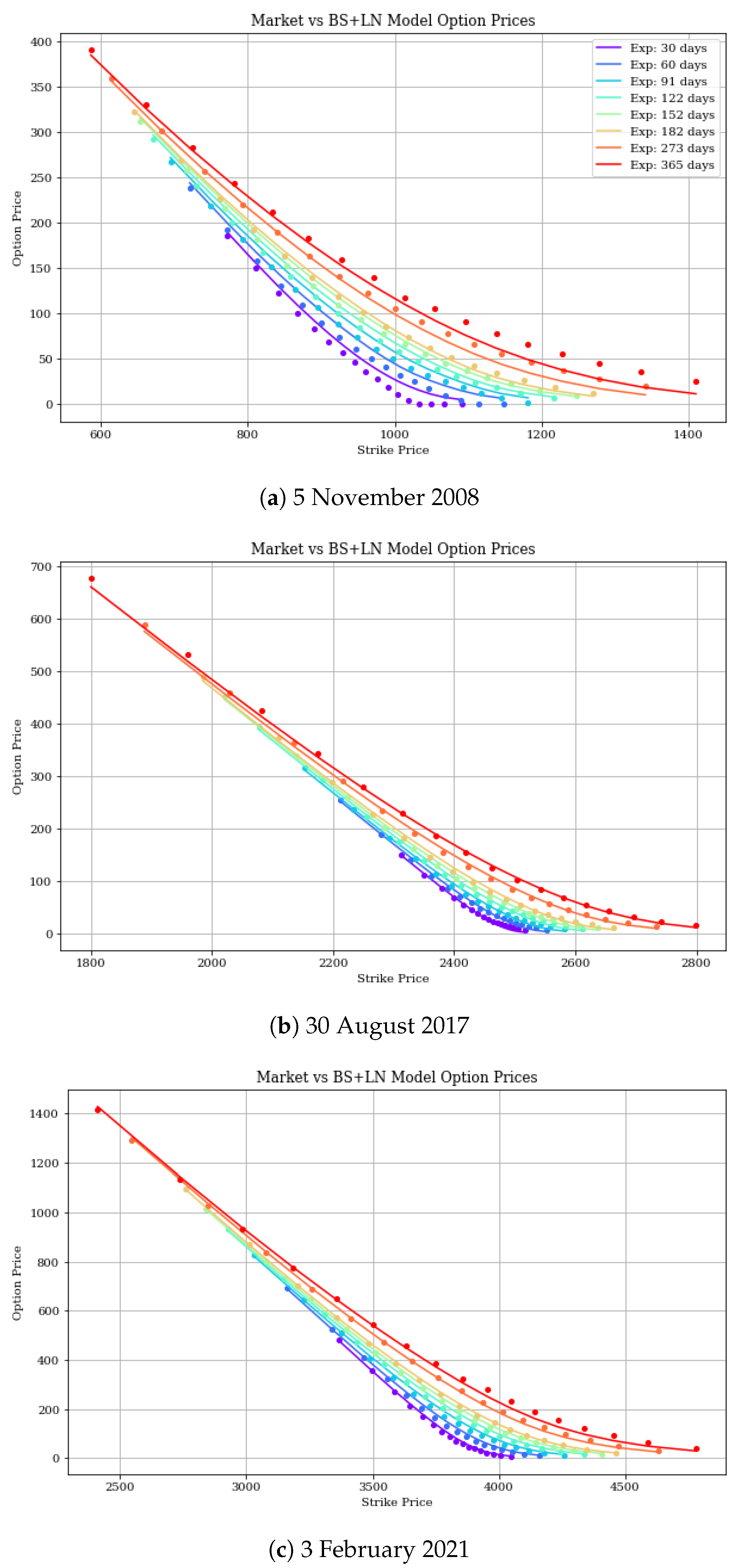

Mathematics | Free Full-Text | Option Pricing under a Generalized

Interest Rate Call Option - What Is It, Examples, Benefits, Risks

Introduction to Black Model for Interest rate caps

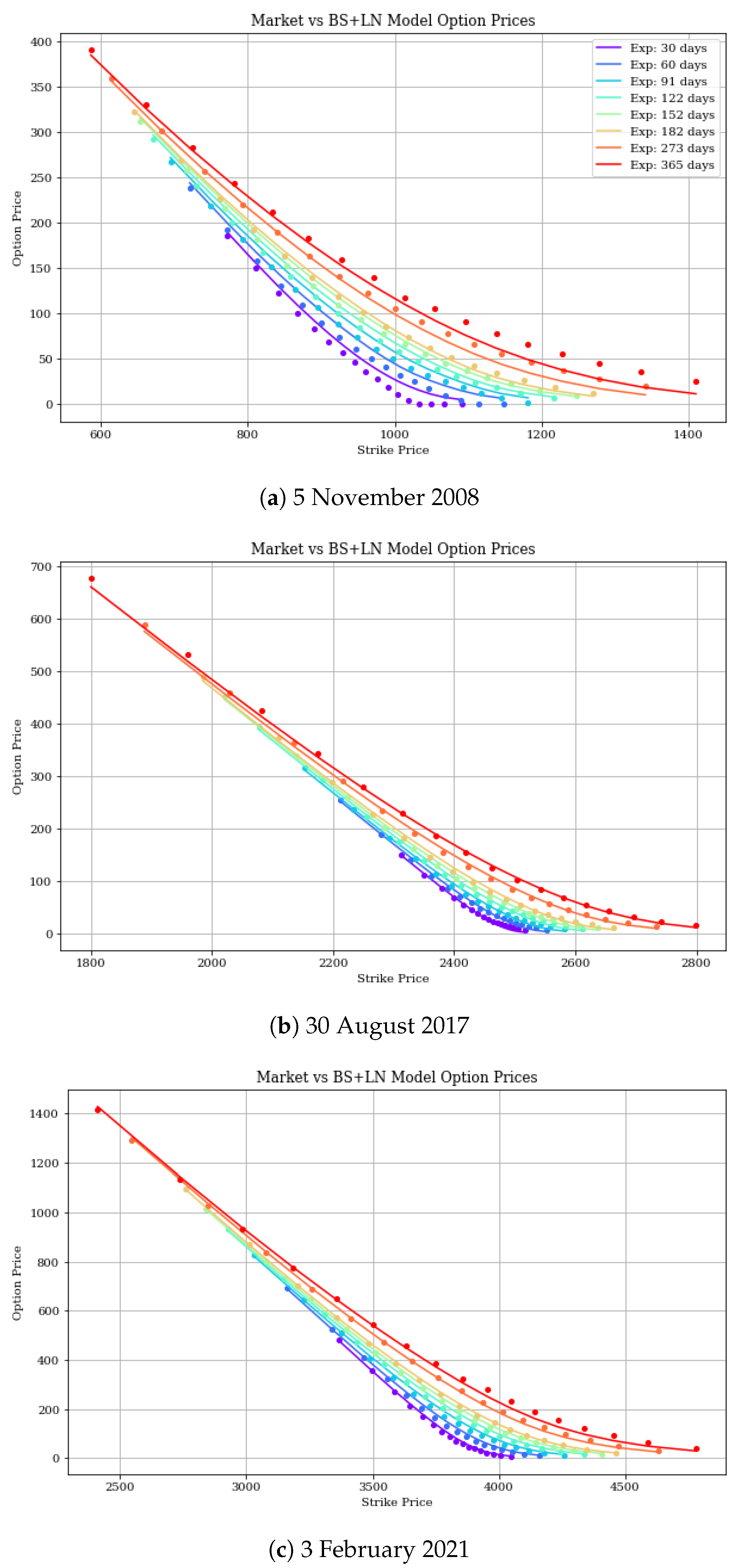

PDF) Pricing and Hedging Interest Rate Options: Evidence from Cap

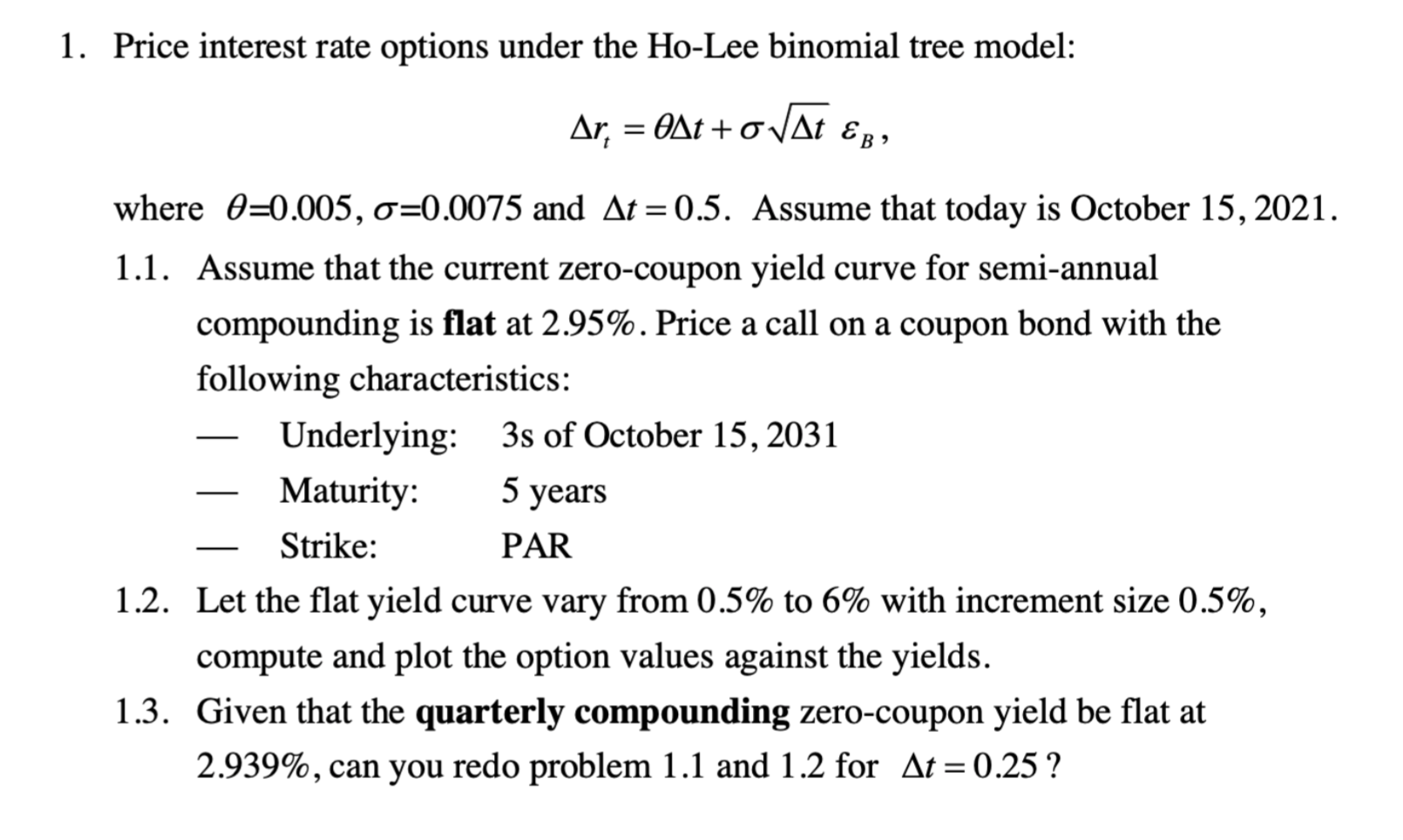

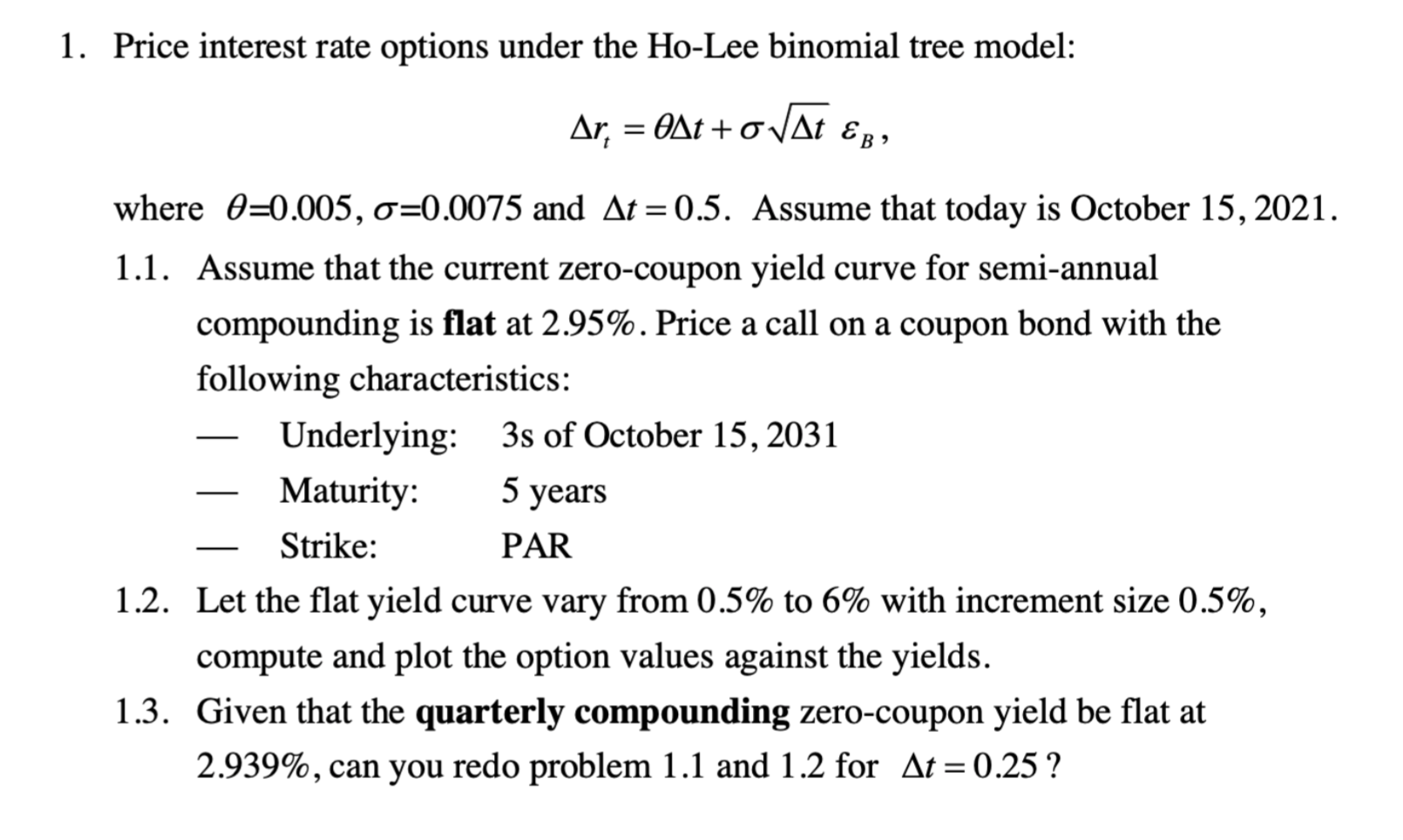

1. Price interest rate options under the Ho-Lee | Chegg.com

Interest-Rate Option Models : Understanding, Analyzing and Using Models for Exotic Interest-Rate Options (Wiley Series in Financial Engineering)

Interest-Rate Option Models:... by Rebonato, Riccardo

Interest-Rate Option Models : Understanding, Analyzing and Using

Interest-Rate Option Models:... by Rebonato, Riccardo

Valuation of an Interest Rate Option (2022 curriculum) - CFA, FRM

How and Why Interest Rates Affect Options

Navigating Interest Rate Options with Binomial Trees - FasterCapital

Interest Rate Options - What Is It, Examples, Types, Advantages

Interest-Rate Option Models: Understanding, Analysing and Using

Work with Negative Interest Rates Using Objects - MATLAB

CFA Level 2 | Derivatives: Valuing Interest Rate Options Using

Calculation flow chart of option-adjusted spread. | Download

Black Model Valuation of Interest Rate Options and Swaptions - CFA

Modeling Fixed Income Securities and Interest Rate Options (Chapman and Hall/CRC

Interest Rate Derivatives: More Advanced Models Chapter 24

Option Prices in the Variance Gamma Model - Wolfram Demonstrations

Interest Rate Options - Overview, Importance, Risks

Understanding the Binomial Option Pricing Model

Interest Rate Derivatives and Mark to Market Losses: A

10 1 Introduction to interest rate models Part 1

Stochastic interest rate models news and analysis articles - Risk.net

Call option prices, volatility and interest rate in the Black

BLACK - SCHOLES -- OPTION PRICING MODELS

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-02-ba51015e895b4ba7abbd7632e1908360.jpg)

Option Pricing: Models, Formula, & Calculation

Interest Rate Options in Multifactor Cox-Ingersoll-Ross Models of

Interest Rate Derivatives: Models of the Short Rate - ppt download

Interest Rate Models - Theory and Practice: With Smile, Inflation and Credit (Springer Finance)

Navigating Interest Rate Options with Binomial Trees - FasterCapital

The price option profile f() against for various risk-free

Interest Rate Models and Negative Rates | FINCAD

Navigating Interest Rate Options with Binomial Trees - FasterCapital

black model-interest rate option-有问必答-品职教育专注CFA ESG FRM

How to Price Interest Rate Options with Negative Interest Rates

Chapter 30 Interest Rate Derivatives: Model of the Short Rate

Interest rates: The Impact of Interest Rates on Prepayment Models

Mathematics | Free Full-Text | Option Pricing under a Generalized

Interest Rate Call Option - What Is It, Examples, Benefits, Risks

Introduction to Black Model for Interest rate caps

PDF) Pricing and Hedging Interest Rate Options: Evidence from Cap

1. Price interest rate options under the Ho-Lee | Chegg.com

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています